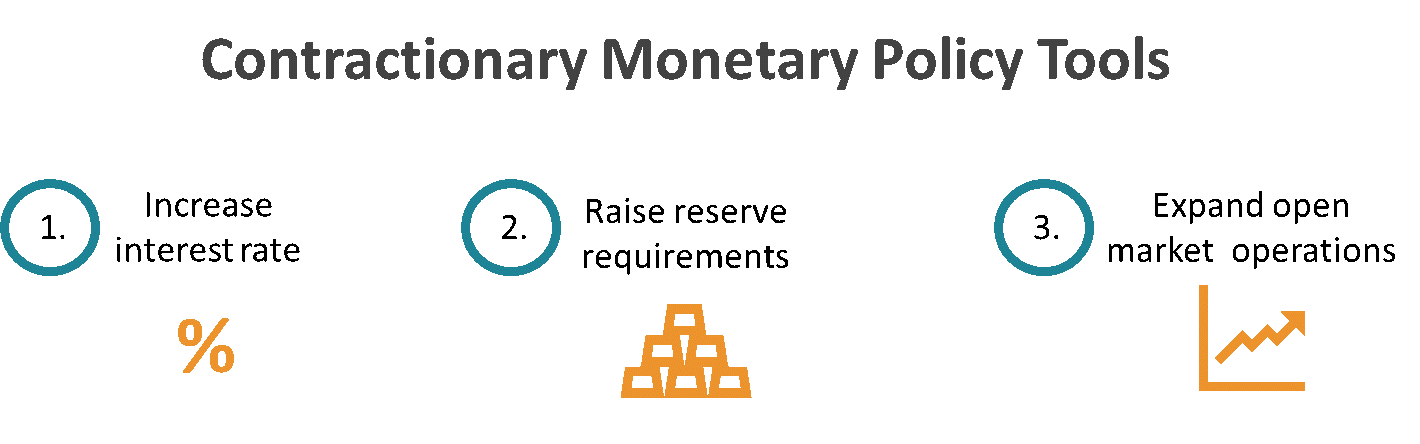

The three major tools of monetary policy are the reserve requirement open market operations and the discount rate. Central banks will increase interest rates to slow the flow of.

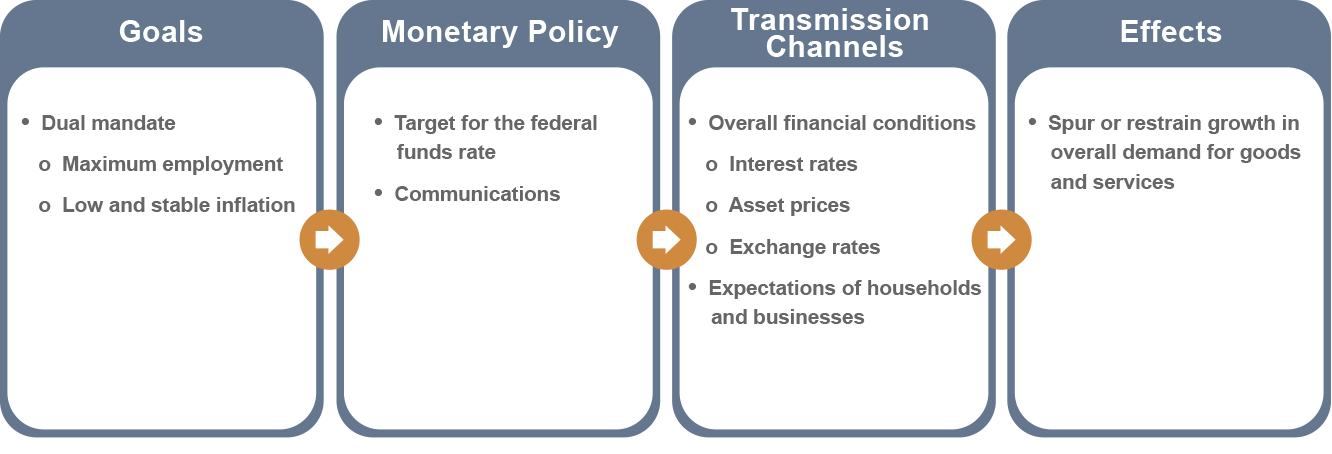

Federal Reserve Board Monetary Policy What Are Its Goals How Does It Work

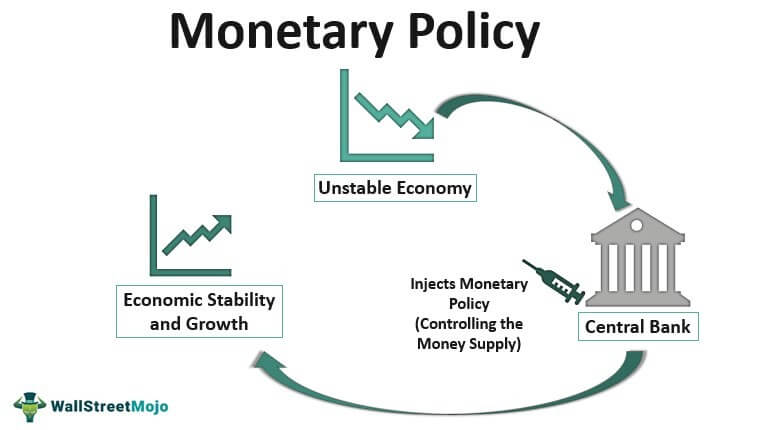

A central bank has three traditional tools to implement monetary policy in the economy.

. 2How do open market operations work. Through the use of these three tools the Fed can manipulate market movements to exercise control over the economy. 3 Tool 2 1 point How would the tool be used.

Changing the discount rate which is the interest rate charged by the central bank on the loans that it gives to other commercial banks. Government securities in the financial markets which. Non Performing Assets NPA Facts for UPSC GS-III.

First of all unit up good money is serves US unit of good and money serves us and medium of exchange. Reserve Requirement Increasing or decreasing reserve amount requirements of the bank that are set aside to meet emergency fund requirements for consumers. The term open market means that the Fed doesnt decide on its own which securities dealers it will do business with on a.

1How can you describe the three major tools of monetary policy. Its asking how this inflation affect the ability of money to serve each of these functions. Open market operations involve the buying and selling of government securities.

Open market operations are the purchases and sales of bonds by the Federal Open Market Committee. An Introduction What are the tools of US. Open market operations Changing reserve requirements Changing the discount rate In discussing how these three tools work it is useful to think of the central bank as a bank for banksthat is each private-sector bank has its own account at the central bank.

Functions and Composition in the given link. A central bank has three traditional tools to implement monetary policy in the economy. Change reserve requirements Central banks usually set up the minimum amount of.

Explain why such action would increase the money supply. Describe the three tools of monetary policy. Let us define monetary policy and then.

Using open-market operations the Fed trades US. The Federal Reserves three instruments of monetary policy are open market operations the discount rate and reserve requirements. 3What are revenue deficit and debt and how does it play a role in the U.

Bond purchases are used to expand the money supply while bond sales are used to contract the money supply. However the basic object of. What are the three tools of the monetary policy.

The main three tools of monetary policy are open market operations reserve requirement and the discount rate. How would the tool be used. How would the tool be used.

The reserve requirement is a rule stating that a percentage of every deposit be set aside as legal reserves. The widely utilized policy tools include. 2How do open market operations work exactly.

Taxes reduce income of individuals and companies and thus reduce private expenditures on motor cars television sets or liquor. Government securities over the open marketplace. Open Market Operations Buying and selling Bonds Reserve Requirement The reserve requirement reserve ratio is.

The three main tools of monetary policy used by the Federal Reserve are open-market operations the discount rate and the reserve requirements. Click again to see term. Tap card to see definition.

Tap again to see term. The three main tools of monetary policy are open market operations reserve requirements and interest rates. 3 Shifters of Money Supply The FED adjusting the money supply by changing any one of the following.

Can change the requirement for all checking time or saving accounts in the country. The Fed constantly buys and sells US. The three tools of monetary policy are.

List the three major monetary policy tools the Federal Reserve can use to increase money supply. Setting Reserve Requirements Ratios 2. The following points highlight the three major tools used by government to influence private economic activity.

The major tool the Fed uses to affect the supply. Open Market Operations central bank buying or selling securities to expand or contract the money supply. 1How can you describe the three major tools of monetary policy.

Lending Money to Banks Thrifts Discount Rate 3. What are the 3 tools of monetary policy. Interest rate adjustment A central bank can influence interest rates by changing the discount rate.

So we can first take a look at all these three functions. Economics questions and answers. This is the interest rate that banks pay on short-term loans from a Federal Reserve Bank.

Click card to see definition. Are is what I talk down here. Pon 3 point Question.

Instead it affects them indirectly mainly by raising or lowering a short-term interest rate called the federal funds rate. The Fed cant control inflation or influence output and employment directly. Open market operations discount rate reserve requirements are the 3 tools of monetary policyYou can read about The Reserve Bank of India.

During periods of inflation monetary policy becomes increasingly important. The third money is a store of value on the question seven.

Contractionary Monetary Policy Definition Tools And Effects

Monetary Policy Definition Types Examples Tools

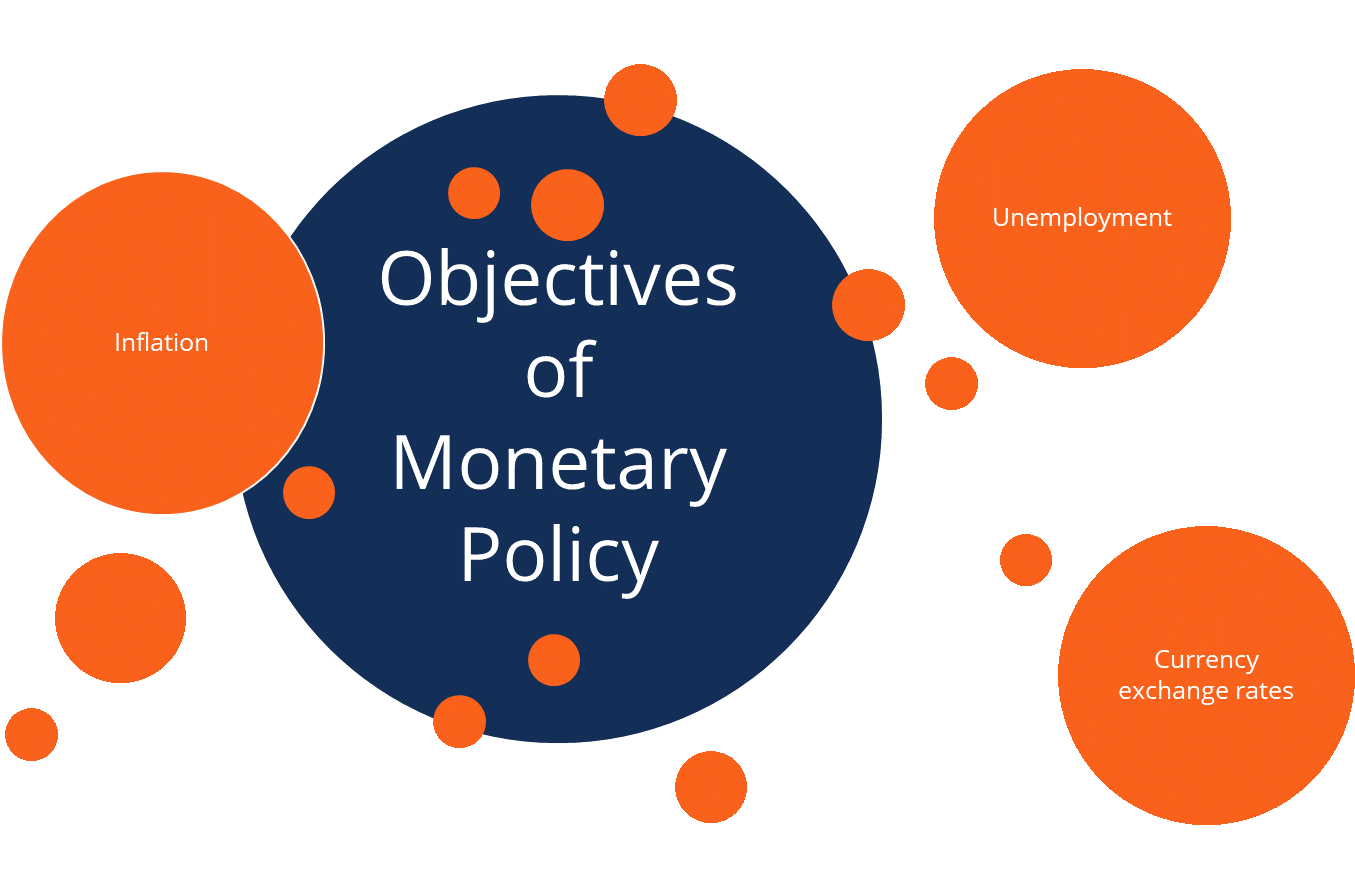

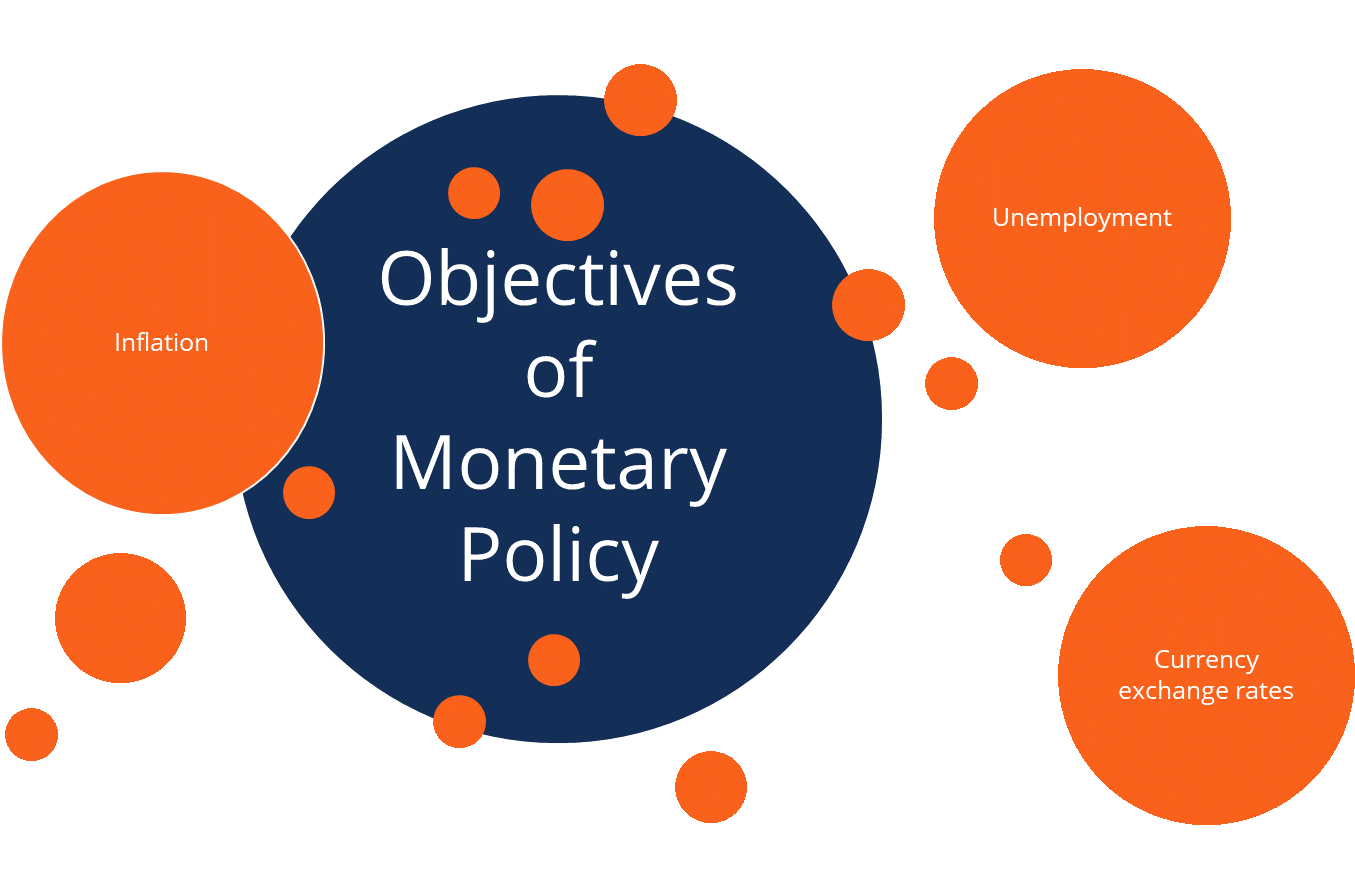

Monetary Policy Objectives Tools And Types Of Monetary Policies

0 Comments